ev tax credit 2022 status

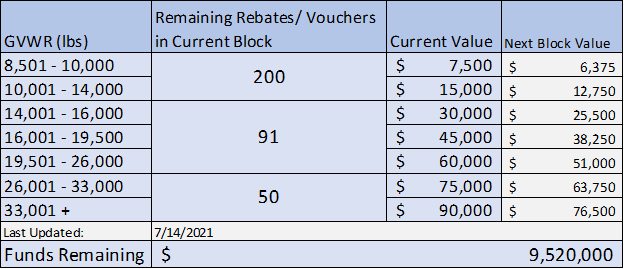

The credit ranges between 2500 and 7500 depending on the capacity of the battery. The credit begins to phase out for a manufacturer when that manufacturer sells 200000 qualified vehicles.

Joseph Szczesny Executive Editor.

. News World Report how much the EV tax credit can save you largely depends on your tax status making it important to speak with a tax professional before finalizing your purchase. The tax credit is also. We are currently updating sales estimates through December 31 2021 for the automakers.

The State of Texas offers a 2500 rebate for buying an electric car. 7 hours agoThis includes at minimum the 7500 federal tax credit for EV sales. The credit must be used in its entirety in the year of purchase.

When the aforementioned 12 trillion. January 13 2022 If youve been shopping for or researching an electric vehicle youve almost certainly heard about things like EV tax credits specifically the federal governments offer of a. Under current IRS code consumers who buy a qualified plug-in electric drive motor vehicle may qualify for a federal tax credit worth up to.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. If thats the case you could save up to 7500 on the EV pickup. The amount of the credit will vary depending on the capacity of the battery used to power the car.

You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25. However according to US. 2 Must be used in 2022.

Electric vehicle drivers save 500-1500 per year in refueling costs compared to gasoline. Plug-in hybrid electric vehicles are eligible for a 3000 tax credit only for individuals making 50000 or less or married couples making 75000 or less. While the tax credit is a useful method of stimulating sales and purportedly removing gas-powered vehicles off the roads it comes with a catchmanufacturers can extend the credit to 200000 EV sales in year.

Even an EV with a much smaller battery capacity say 16 kWh would max out the tax credit. Many EVs these days have a 100 kWh battery which would easily max out that 7500 credit. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandoned.

Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. The exceptions are Tesla and General Motors whose tax credits have been phased out.

Arizona Tuscon Electric Power TEP up to 9000. The EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. The logjam on Capitol Hill also means buyers of EVs from General Motors and Tesla remain.

Only the original buyer of a qualified. For example if you owed 5000 in federal taxes and received a 7500 federal tax credit for buying an electric car your taxes would be reduced to 0. Updated April 2022.

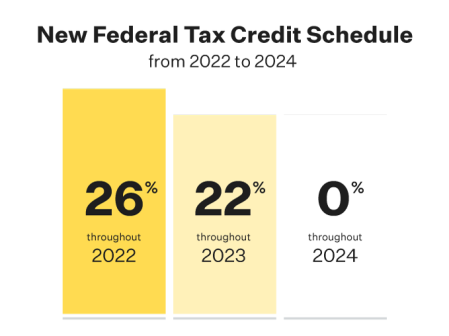

There are of course conditions to the credit which include. Federal Tax Credit 200000 vehicles per manufacturer. Rebates in the form of tax credits are simply dollars subtracted from the amount of tax.

As more electric vehicles reach dealer showrooms EV tax credits are stuck in a legislative limbo according to observers on Capitol Hill. Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold likely in Q1 of 2022. If you purchased a Nissan Leaf and your tax bill was 5000 that.

President Bidens EV tax credit builds on top of. The car must be purchased as a new car. Still you would not receive a 2500 refund check from the IRS.

421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal. The renewal of an EV tax credit for Tesla provides new opportunities for growth 2. Customers who purchase EV chargers between July 2021 to Dec 2022 can receive to 250.

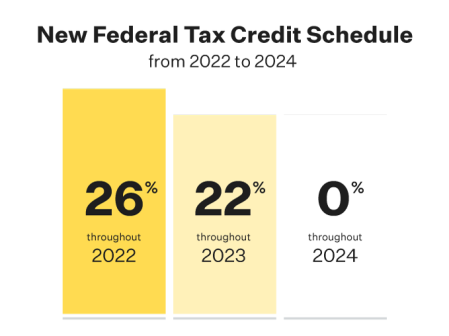

New EV Federal Tax Credit Update. Sales of electric vehicles like the Ford Mustang Mach-E have been on the rise. Latest on Tesla EV Tax Credit March 2022 The Clean Energy Act for America would have a positive impact on Tesla by making most Tesla cars eligible for an 8000 House version or 10000 Senate version refundable tax credit and handicapping Chinese EVs from entering the US market.

Texas EV Rebate Program 2000 applications accepted per year. The US Federal tax credit is up to 7500 for an buying electric car. 2022 which have risen since then and 2021 average.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. XC40 Recharge Pure Electric P8 AWD. There is a federal tax credit of up to 7500 available for most electric cars in 2022.

C40 Recharge Pure Electric. This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate version. This is a combination of the base amount of 4000 plus 3500 if the battery pack is at least 40 kWh.

For instance in my home state of Vermont state incentives tax credits are offered for electrified vehicles. State and municipal tax breaks may also be available. What Is the New Federal EV Tax Credit for 2022.

76 rows Status of the 12500 federal tax credit for EVs. Often instead of cash utilities or municipalities will offer a tax credit for an electric vehicle charging station. EVAdoption will update our Federal EV tax credit phase-out tracker a few times per year so check back on a regular basis.

Currently the plug-in electric drive vehicle tax credit is up to 7500 for qualifying vehicles. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. Incentives will vary depending on where you live.

Now say the 2022 Ford F-150 Lightning is eligible for EV tax credits. An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Southern California Edison Incentives

Wisconsin Solar Incentives Rebates And Tax Credits Sunrun

How Electric Vehicle Tax Credits Work

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopReasonsToBuyEV.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Mor Ev Rebate Program Mass Gov

Incentives Austin Energy Ev Buyers Guide

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

Federal Tax Credits Will Soon Be Phased Out For Toyota Ev Customers In The Us Electrek