ny paid family leave tax code

Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020. This is NY state disability insurance tax withheld.

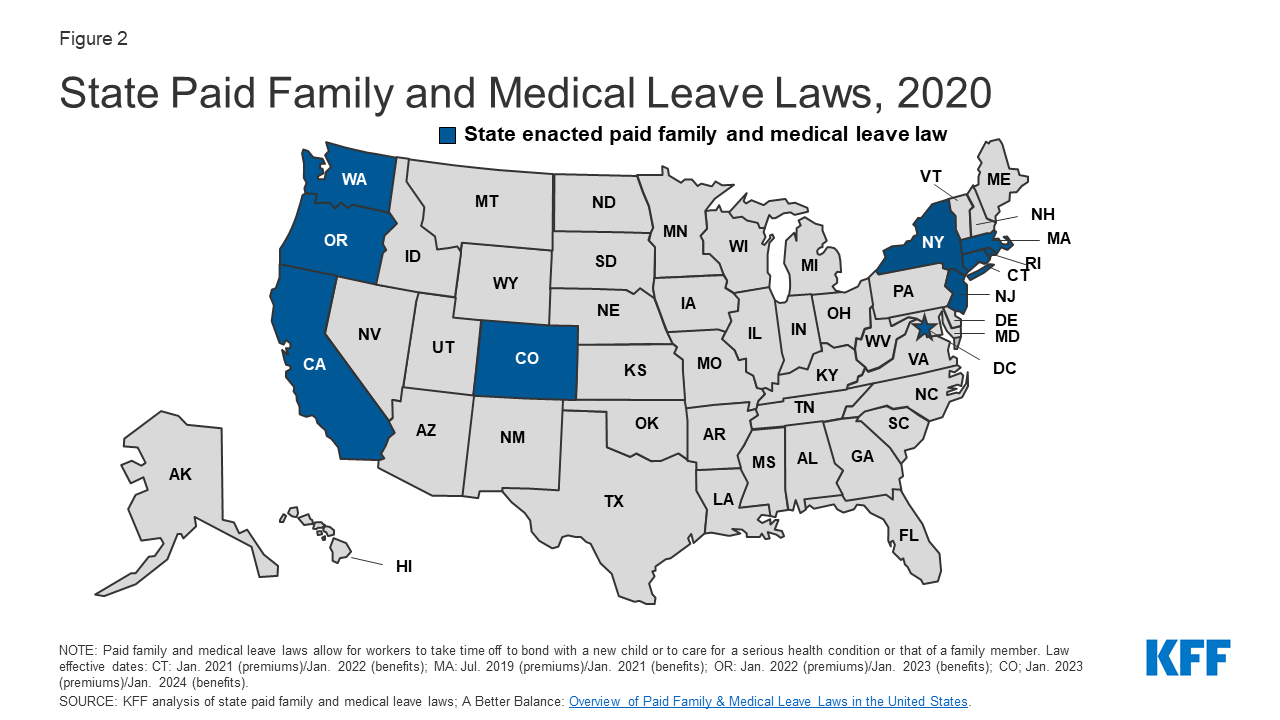

Time Off To Care State Actions On Paid Family Leave

Barbara makes less than 6790784 per year.

. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or. Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage. The state begins requiring mandatory withholding beginning with checks dated on or after January 1 2018.

New York State Department of Labor - Unemployment nygov. The state begins requiring mandatory withholding beginning with checks dated on or after January 1 2018. The New York Paid Family Leave NYPFL insurance tax requires New York employers to obtain an insurance policy or self-insured plan that is funded by employee contributions.

What Is Ny Paid Family Leave Tax. We have reviewed the New York statute implementing regulations and applicable laws caselaw and federal guidance. At this time it appears that employees can choose to withhold a flat 10 percent of their benefit for federal taxes and a flat 25 percent of their benefit for state taxes.

Ny paid family leave tax code Friday March 11 2022 Edit. Use the code Other mandatory. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

The maximum 2021 annual contribution will be 38534 up from 19672 for 2020. New York Paid Family Leave is insurance that is funded by employees through payroll deductions. The check box on the uncommon situations screen is for PFL benefits that you received that are included in your W-2.

It is DEDUCTIBLE and should be coded as such. What Is Ny Paid Family Leave Tax. They are however reportable as income for IRS and NYS tax purposes.

Paid Family Leave may also be available. Request For Paid Family Leave Form PFL-1. If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could.

The NYPFL is a state-administered program that provides paid leave. Employees can take Paid Family Leave to care for a close family member with a serious health condition including family members outside of New York State. Paying the tax does not mean that you received any benefits.

If you put it in Other - not on the list above it will not carry to state taxes in itemized deductions. Paid Family Leave can be taken to bond with a new child within 12 months of the childs birth adoption or foster placement. The maximum annual contribution is 42371.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period. September 2020 Business Due Dates Due Date Business Income Tax Return New York Paid Family Leave Updates For 2022 Paid Family Leave How Do State And Local Sales Taxes Work Tax Policy Center. As of January 1 2021 must provide up to 56 hours of paid safe and sick leave if the employer employs 100 or more employees.

Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. Paid Family Leave provides eligible employees job-protected paid time off to. Paid Family Leave provides eligible employees job-protected paid time off to.

The state may provide further guidance in the future. Pursuant to the Department of Tax Notice No. The States new Paid Family Leave program has taximplications for New York employees employers and insurance carriers including self-insured employers employer plans approved third-party insurers and the State Insurance Fund.

Ny paid family leave tax code Sunday March 20 2022 Edit. Employers should report employee payroll contributions on Form W-2 using Box 14. If you did not take paid family leave you did not receive any PFL benefits so you do not check the box.

Subpart A Tax Conventions and Other Related Items and. State Disability Insurance Taxes Withheld. The NYPFL in box 14 is PFL tax that you paid.

The maximum annual contribution is 42371.

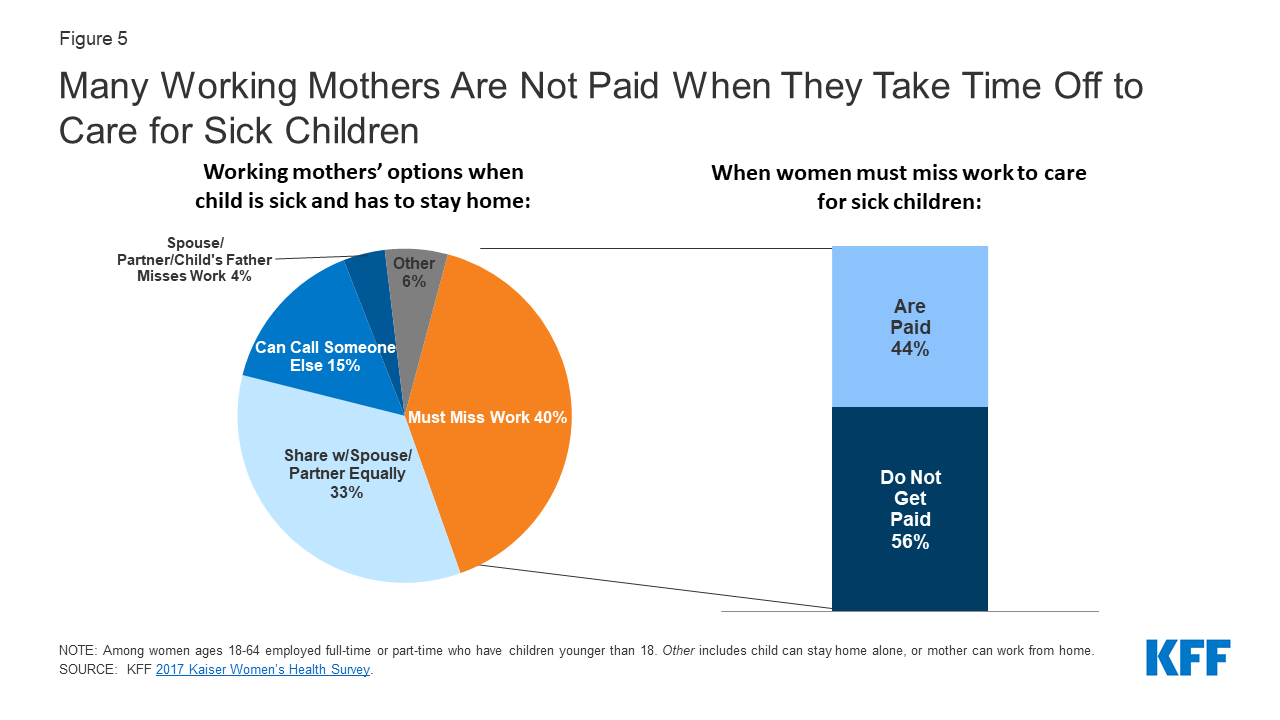

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

Paid Family Leave For Family Care Paid Family Leave

New National Paid Leave Proposals Explained

New York State Paid Family Leave Cornell University Division Of Human Resources

Why We Talk About Paid Family Leave In Only Economic Terms Time

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Paid Parental Leave Around The World And How The U S Compares The Washington Post

Universal Paid Family And Medical Leave Under Consideration In Congress Kff

Coronavirus Puts A Spotlight On Paid Leave Policies Kff

Opinion Both Parties Are Getting It Wrong On Parental Leave Politico

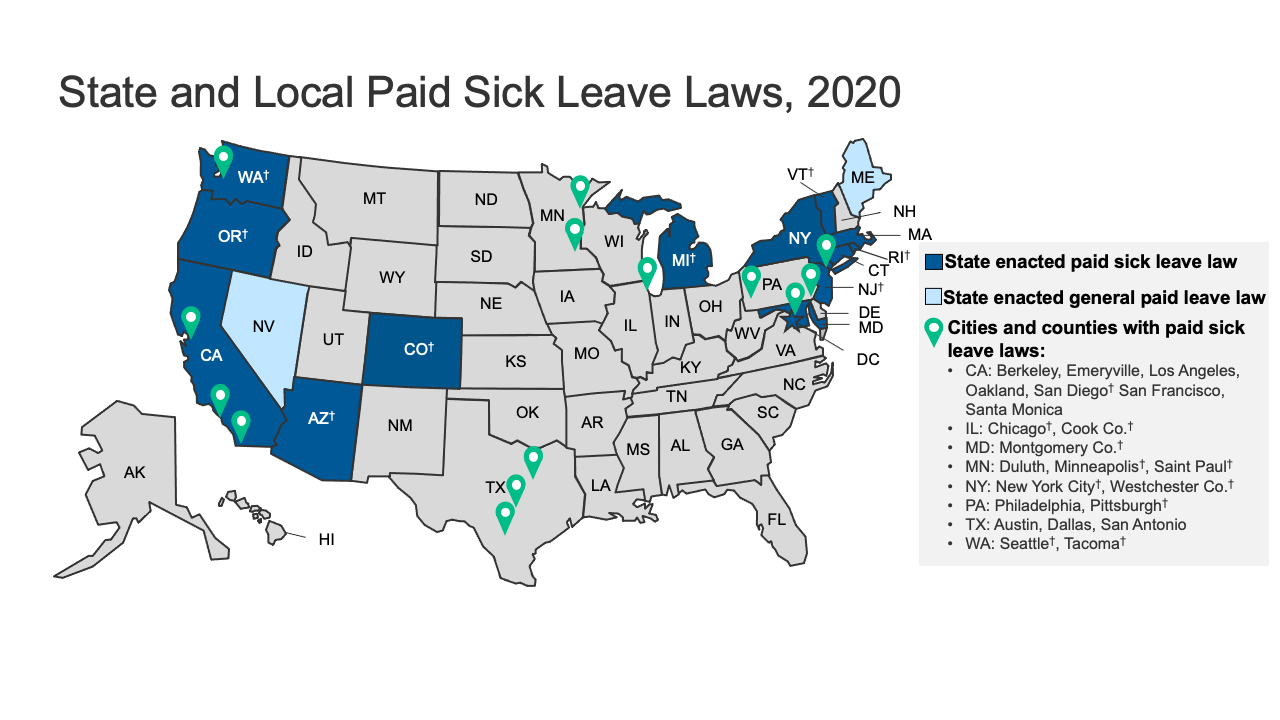

Paid Sick Leave Laws By State Chart Map And More

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Time Off To Care State Actions On Paid Family Leave

Irs Crypto Crackdown Likely To Be Delayed Giving Tax Cheats A Reprieve Bloomberg

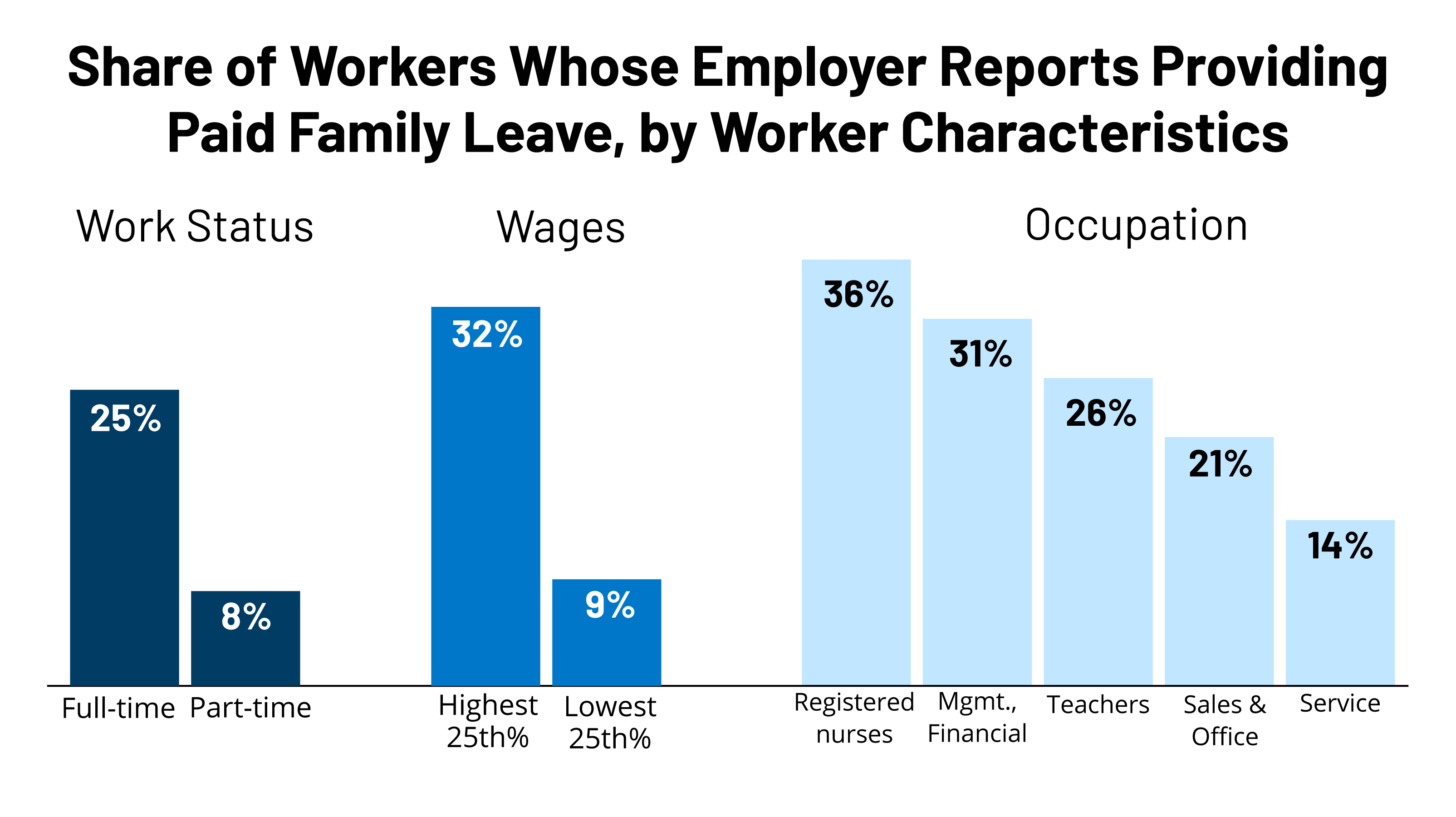

Explainer Paid Leave Benefits And Funding In The United States

Paid Leave Is Good For Small Business Center For American Progress